Why We’re Wrong About the US Tax Policy (catchy, right?)

This week, I read Why We’re Wrong About Nearly Everything by Bobby Duffy.[1] I will give a brief overview of the book, provide a self-deprecating example, and then apply the framework to the contemporary if not dry subject of federal taxation and spending.

This book focuses on why people are often deluded about everyday political and economic topics. Duffy uses survey data to illustrate his points and frequently references Daniel Kahneman’s work to explain the underlying biases and heuristics for our misconceptions.[2]

Duffy raises the concept of post-truth, the idea that public opinion is shaped by emotion and personal belief rather than objective facts.[3] Society is deeply biased by individual worldviews. Delusion, or misperception, differs from ignorance in that people hold the former “with a high degree of certainty . . . and consider themselves to be well informed.”[4] That last phrase is key, as objective facts which contradict preconceived notions are troublesome knowledge that can be emotionally rejected. Duffy illustrates this insistence on the delusion using opinion polling on immigration, with applicability to vaccines and climate change.[5]

Duffy’s premise for Why We’re Wrong:[6]

- We get social and political facts very wrong.

- This is as much about how we think as what we are told.

- Delusions are biased due to emotions and perceptions.

- Delusions can shape social and political realities.

- The problem is complex and widespread.

Duffy references Kahneman and Tversky’s availability heuristic to explain why people use themselves as a benchmark for viewing others.[7] I will use a personal example to illustrate this fallacy. Duffy quotes Google’s Hal Varian as saying, “The sexy job in the next 10 years will be statisticians.”[8] I, of course, underline this quote because it aligns with my worldview where society values statisticians. My publications have added to the general knowledge of society and that society owes me their deepest appreciation. If I truly believe this delusion, then I have the social facts very wrong and am emotionally biased by wanting to be celebrated. My delusion is not swayed by the reality that the mere mention of student’s t distribution with non-centrality parameter δ and n-1 degrees of freedom is hardly an effective pick-up line.

(Yes, I wrote the drivel beneath the crayon)

Application of the Framework

In his last chapter, Duffy describes the political polarization of our society and gives ten ideas for forming more accurate views of the world. The list has motivated me to figure out what’s real (idea six) by seeking conversation from different perspectives. This also calls for pursuing the facts (idea eight) and critical thought (idea seven) to overcome the emotionally based arguments between the polar factions.

This morning, I listened to a podcast called “Ten Myths About the U.S. Tax System” hosted by Stephen Dubner.[9] The dialog spoke to many of Duffy’s points like the Dunning-Kruger effect and post-truth. The interviewee, Jessica Riedl, was a graduate student under Daniel Kahneman. Riedl is a senior fellow in budget, tax, and economic policy at the Manhattan Institute. She published her myths to draw attention that neither the Democrats nor Republicans have a plan to address the deficit between taxation and spending and that, unchecked, the building national debt will severely challenge future generations.[10]

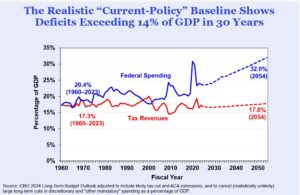

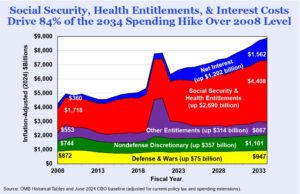

The two primary political parties campaign on different idealisms. Republicans typically campaign on lower taxes and lower spending. Democrats campaign on higher taxes on the rich to pay for more spending. Riedl presents CBO data to show that taxes have stayed within a narrow band of GDP percentage but spending has outpaced taxes for all but a few years since 1970. Since the economic crisis of 2008, defense and nondefense discretionary spending has been flat. The dramatic increase in spending comes from Social Security, Medicaid, Medicare, interest on the national debt, and other entitlement spending coming out of the pandemic. This appears to be a case where both sides hold delusions. No matter which party holds power, tax revenue is roughly constant compared to GDP and spending exceeds revenue.

U.S. Government Deficit Spending[11]

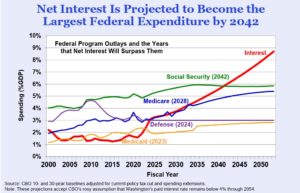

The situation is an example where Duffy urges us to understand the facts. The deficit is driven by spending, not by tax policy. Both Democrats and Republicans have strong emotions over Elon Musk and DOGE. Based on spending projections, DOGE will not significantly alter deficit spending by considering only nondefense discretionary spending. A recent NY Times opinion piece put DOGE savings at $2billion—or 1/35 of 1 percent of the federal budget—versus the claimed $55 billion.[12] Neither truth has a material effect on the budget deficit. Riedl projects interest payments on the debt will be 27 percent of federal revenues by 2034 and become the largest federal expense by 2042. In another publication, Riedl writes that the Democrat solution to tax the rich cannot change the trend, pointing to Bernie Sanders 2020 campaign which proposed a $23 trillion tax increase on wealth and an $87 trillion increase in spending.[13] The facts oppose the narratives provided by both parties.

The Rising Cost of National Debt[14]

During the podcast wrap-up, Dubner described Kahneman’s observation that “people are really bad at making decisions now with the future in mind.”[15] Politicians today are very unlikely to get elected campaigning on the reality of Social Security and Medicare driving deficit spending. The cost of budget deficits today is born by the next generation and can get quietly kicked down the road. Duffy ends by writing, “There is no magic formula to deal with our delusions.”[16] If Riedl’s facts and projections are accurate, it will take much more than delusional rhetoric to alter the current trajectory.

[1] Bobby Duffy. Why We’re Wrong about Nearly Everything: A Theory of Human Misunderstanding. First US edition. (New York: Basic Books, 2019).

[2] Daniel Kahneman. Thinking, Fast and Slow. 1st pbk. ed. (New York: Farrar, Straus and Giroux, 2013).

[3] Duffy, 7.

[4] D.J. Flynn, Brendan Nyhan, and Jason Reifler. “The Nature and Origins of Misperceptions: Understanding False and Unsupported Beliefs About Politics,” in “Advances in Political Psychology,” special issue, Political Psychology 38, no. S1 (February 2017): 127-150. https://doi.org/10.1111/pops.12394.

[5] Duffy, 97-99.

[6] Duffy, 20.

[7] Duffy, 28.

[8] “Hal Varian on How the Web Challenges Managers,” McKinsey & Company, January 1, 2009, https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/hal-varian-on-how-the-web-challenges-managers.

[9] Stephen J. Dubner. “Ten Myths About the U.S. Tax System,” produced by Theo Jacobs, Freakonomics Radio, March 14, 2025, podcast, episode 626. https://freakonomics.com/podcast/ten-myths-about-the-u-s-tax-system/.

[10] Jessica Riedl. “Correcting the Top 10 Tax Myths,” Manhattan Institute, December 12, 2024, https://manhattan.institute/article/correcting-the-top-10-tax-myths.

[11] Brian Riedl. “Spending, Taxes, and Deficits: A Book of Charts,” Manhattan Institute, November 2024, https://media4.manhattan-institute.org/wp-content/uploads/Budget-Chart-Book-2024.pdf.

[12] David French. “Elon Musk and the Useless Spending-Cut Theater of DOGE,” New York Times, March 5, 2025.

[13] Jessica Riedl. “The Limits of Taxing the Rich,” Manhattan Institute, September 21, 2023, https://manhattan.institute/article/the-limits-of-taxing-the-rich.

[14] Riedl, “Spending, Taxes, and Deficits: A Book of Charts,” 57.

[15] Dubner, 58:10.

[16] Duffy, 240.

6 responses to “Why We’re Wrong About the US Tax Policy (catchy, right?)”

Leave a Reply

You must be logged in to post a comment.

Rich,

Thanks for sharing this and layering in the perspective that the tax revenue as a % of GDP is relatively consistent regardless of the party identity.

When looking at the 8th idea of pursuing the facts, there has to be a base level of understanding for that to be of value. In your example above, unless the individual knows that the 2B is not a significant amount of the deficit, they would simply assume (misperceptions) that it’s a large number. But unless that context is rounded out – well, it’s only 1/x of the total spend – their understanding is incomplete and doesn’t provide the total and complete perspective.

This is similar to the understanding that batting .400 in baseball has only been achieved by 36 people, and the last time was back in 1941. The objective viewer would think that not getting a hit 6/10 times is an inferior result. How can we raise the collective bar of understanding?

Duffy’s idea 8 got an ‘x’ next to it. He has done a brilliant job of demonstrating that our perception of social and political issues is determined despite the facts. Fact-based arguments work for my personality—most of the time—but didn’t get very far when discussing vaccinations, masks, protests over George Floyd, the blue line, and the other social issues that divided my church and my home group a couple of years ago.

My perspective is probably why Duffy included the 8th idea. Doling out facts from the corner of superiority doesn’t win many friends.

Which then gets to my post. I completely laugh at myself for spending five hours of my Saturday digging through historical and projected tax and spending data. Who has the time, interest, and background to do that? Few, and they (I) should do this with the understanding that such clear (ahem) data are not persuasive. I found the subject fascinating because the objective data demonstrates that both sides are delusional. I have no personal delusions that my blog will get likes and retweets.

Rich,

Your post had me smiling, both from your rather British-esque self-deprecating humor and your balanced and thoughtful analysis of tax policy and campaign messaging.

Another big problem I see here is the “psychic numbing” effect. $2bn and $2tn sound the same, right? It’s hard for most of us to psychologically truly grasp the scale of the problem we’re dealing with.

So, Rich for President 2028?

I can see the headline now. “Local candidate garners 27 write-in votes, says the American people are wrong about nearly everything.” However, one of the 32 MechE students from my undergraduate class is getting some conversation for ’28. Glen Youngkin has a more presidential hairstyle than mine.

Rich,

Given the influence of cognitive biases and emotional responses in shaping people’s views on complex topics like federal taxation and spending, In your opinion, how can we as individuals overcome our own biases when engaging with political issues, especially when political narratives are so deeply rooted in emotional and ideological beliefs? What strategies could help bridge the gap between objective data and public opinion on such polarizing matters?

Great question, Linda. In this time of questioning whether our news and information is unbiased, it is really helpful to seek multiple sources. I’ll give an example.

Last Thursday, I was in a long conversation with a friend who is happy to share his opinions. One was on fluoride in the public water systems. I will admit that I shared his sentiment but not reveal the side. The next day, I listened to a Wall Street Journal podcast that was covering the same topic. The coverage was balanced. It covered the original study that concluded fluoride reduced the incidents of tooth decay and the recent studies on the correlation between high levels of fluoride and low IQ in children. I feel much better informed on the arguments, give some credibility to a portion of both sides, and could advocate a position that borrows from both extremes. Had I not gone looking, I would have been content speaking against what I did not understand, sticking instead with the one thing that I barely knew about. I shared my new perspectives with my friend and was met with an unemotional and thoughtful “oh . . .”